colorado springs sales tax rate

Commerce City CO Sales Tax Rate. Colorado Sales Tax 1 Revised August 2021 Colorado imposes sales tax on retail sales of tangible personal property.

How To Pay State And Online Sales Taxes In 9 Steps Tax Deductions Sales Tax Tax

Instructions for City of Colorado Springs Sales andor Use Tax Return.

. The extension though is at a reduced rate of 057. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. January 1 2016 through December 31 2020 will be subject to the previous tax rate of 312.

307 Sales and Use Tax Return in Spanish. This vehicle is registered correctly in the mountain county and no sales or use tax is due to colorado springs. With five military installations and.

What is the sales tax rate in Colorado Springs Colorado. To review these changes visit our state-by-state guide. 2 days agoAnd when they make those purchases Colorado Springs residents generate taxes for other cities rather than for their hometown.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. Welcome to the City of Colorado Springs. Bobs garage must collect sales tax on 2995 from their customers.

City sales tax collected within this date range will report at 312. Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8There are a total of 276 local tax jurisdictions across the state collecting an average local tax of 4075. Colorado Springs CO Sales Tax Rate.

Highlands Ranch CO Sales Tax. None if net taxable sales are greater than 100000000. When purchasing a new car the individual p roperly paid city sales tax to the dealer and.

The Colorado state sales tax rate is currently. 307 Sales and Use Tax Return. You can print a.

Colorado Springs CO 80909. A Colorado Springs resident owns a home in the C ity and a ranch in the mountains. Some Colorado Springs politicians argue that the city should continue rejecting recreational sales because allowing them would compel the US.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Method to calculate Colorado Springs sales tax in 2021. The average sales tax rate in Colorado is 6078.

The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. The County sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v.

Did South Dakota v. On July 12 2021 the City of Colorado Springs Sales Tax Office will be transitioning to a new online licensing and tax filing system powered by MUNIRevs. 31 rows Colorado Springs CO Sales Tax Rate.

Groceries and prescription drugs are exempt from the Colorado sales tax. This is the total of state county and city sales tax rates. Sales Tax Filing and Payment Portal Powered by.

The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax. Property Taxes Property taxes vary a lot based on where you live. Combined with the state sales tax the highest sales tax rate in Colorado is 112 in the cities.

Military to abandon Colorado Springs. Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. Fountain CO Sales Tax Rate.

The vehicle is principally operated and maintained in Colorado Springs. The Colorado Springs sales tax rate is. The colorado springs sales tax rate is 307.

Property taxes are the main source of revenue for schools in Colorado. The minimum combined 2022 sales tax rate for Pagosa Springs Colorado is. On July 12 2021 the City of Colorado Springs Sales Tax Office will be transitioning to a new online licensing and tax filing system powered by MUNIRevs.

Exact tax amount may vary for different items. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Colorado Springs does not currently collect a local sales tax. In general the tax does not apply to sales of services except for those services specifically taxed by law.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. The current total local sales tax rate in Colorado Springs CO is 8200. The Colorado sales tax rate is currently.

The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county sales tax a 312 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. The estimated 2022 sales tax rate for 80920 is. Greeley CO Sales Tax Rate.

City of Colorado Springs Sales and Use tax rate is 312 city collected State of Colorado 29 El Paso County Rate is 123 PPRTA Rate is 10 all 3 entities state collected 513 List of all Colorado Home Rule CitiesCounties please go to wwwcoloradogovrevenue and. This system will greatly improve our businesss experience by allowing businesses to file and pay taxes at any time via an internet connected device view their account history on demand and delegate access to tax. Grand Junction CO Sales Tax Rate.

However in the case of a mixed transaction that. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. Denver CO Sales Tax Rate.

The Colorado Springs sales tax rate is. Fort Collins CO Sales Tax Rate. Sales Taxes In the Colorado Springs area sales tax is 825.

Englewood CO Sales Tax Rate. Has impacted many state nexus laws and sales tax collection requirements. Colorado Springs in Colorado has a tax rate of 825 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Colorado Springs totaling 535.

The GIS not only shows state sales tax information but it also includes sales tax information for counties municipalities and special taxation districts.

About Kim Klapac Colorado Springs Real Estate Kim Klapac Colorado Springs Real Estate Colorado Springs Real Estate

How To Calculate Sales Tax Definition Formula Example

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Sales And Use Tax Collections Rise In February News Csbj Com

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

Sales Tax Information Colorado Springs

Colorado Sales Tax Rates By City County 2022

A Visual History Of Sales Tax Collection At Amazon Com Itep

Freebie How To Calculate Tax Tip And Sales Discount Cheat Sheet 7th Grade Math Teaching Math Sixth Grade Math

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

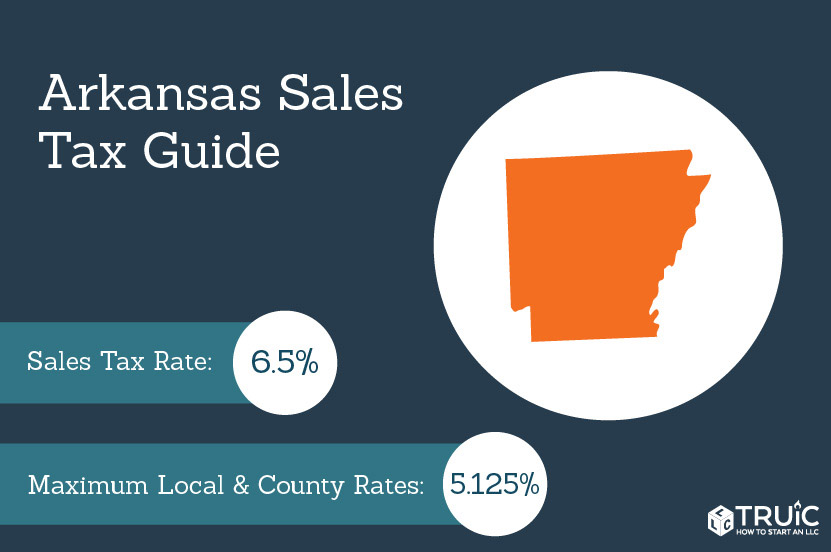

Arkansas Sales Tax Small Business Guide Truic

Sales Tax Information Colorado Springs

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

How Colorado Taxes Work Auto Dealers Dealr Tax

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare