do you pay taxes on a leased car in texas

Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in your lease contract. Do you pay taxes on a leased car.

Auto Sales Are Down Here S Why They Ll Continue To Fall Cars For Sale Car Auctions Car

You see if you own a car you pay taxes on the full value of the car albeit once.

. In a couple of states such as Texas lessees must pay sales tax on the full value of the leased car versus just the tax on payments during the time of the lease. You pay sales tax monthly based on the amount of your payment. Property taxes on the vehicle are not applicable for the lessee.

Texas is the only state that still taxes the capitalized cost of a leased vehicle. When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for the vehicle. Motor Vehicle Leased Outside Texas by Texas Resident - Titled to Leasing Company.

In many leasing contracts companies require their lessees to reimburse them for taxes assessed on the vehicles. Even if you refinanced it at UFCU down the street youd have to pay taxes. Lease car taxes Because lease cars are mostly always brand-new unless you choose to lease a second-hand ex-demo vehicle youll be required to pay this tax across the course of your contract length.

After creating an account youll be able to track your payment status track the confirmation. No tax is due on the lease payments made by the lessee under a lease agreement. Do you have to pay car tax on a leased car.

When you lease a vehicle the car dealer maintains ownership. Any tax paid by the lessee when the motor vehicle was titled and registered in. Texas laws require that the lessor the lease company pay sales tax on the full value of any vehicle they buy from a dealer and lease back to a lessee you and me.

In the state of Texas you pay 625 tax on Trade difference Example. If you dont have a trade then youre simply paying taxes on selling price. No tax is due on the lease payments made by the lessee under a lease agreement.

Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. Seems that Oklahoma had always taxed leased items as property and Texas wanted in on the game. The lease payment and amount of sales tax will be disclosed on the auto lease worksheet.

Car youre buying 50000 Car youre trading 30000 Trade Difference 20000 Taxes 2000006251250. When a motor vehicle is leased in another state and the lessee is a Texas resident or is domiciled or doing business in Texas and brings the motor vehicle into Texas for use the lessee as the operator owes motor vehicle use tax. Technically BMWFS bought the car the first time and the tax was due from.

Do You Have to Pay Taxes on Cash Back Rebates. When it comes to cash-back rebates many car buyers are surprised to learn that most states do tax them. Sometimes the person assuming your lease takes on total responsibility for the duration of the contract while in other cases youre still on the hook for lease payments if they fail to pay them.

The lessor pays 625 percent motor vehicle sales tax when the vehicle is purchased and titled in Texas. With a lease you dont pay the sales tax up front. When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for the vehicle.

Figuring out the tax you have to pay. This comes around once a year - typically January - on leased vehicles. In some states such as Georgia you pay a title ad valorem tax up front on the capitalized lease cost or lease price see Georgia Car Lease for recent changes.

Do you pay sales tax on a lease buyout in Texas. Username Password Confirm Password First Name Last Name Email Phone Contact Address. Basically if you trade it in for 30k and buy a car for 40k youd only pay fees on 10k.

Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. All leased vehicles with a garaging address in Texas are subject to property taxes. There are some available advantages to leasing a vehicle in a business name please consult your tax.

The taxable value of private-party purchases of leased used motor vehicles may be based on 80 percent of the SPV. Lease payments are not taxed in Texas. Do not have an account.

If you do pay the personal property tax. Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. What kind of tax do you pay on a leased car in Texas.

If the vehicle you are purchasing has Tax Credits from the manufacturer LM then your tax. Two general types of. Yes in Texas you must pay tax again when you buy your off-lease vehicle.

Started in 99 IIRC. If you lease you pay a tax which is less than the. In other states generally only the monthly lease payments are taxed similar to the new law in Illinois.

This seems unfair but most states view cash rebates as a form of payment from the manufacturer and conclude that it does not affect the purchase price of the car. Technically there are two separate transactions and Texas taxes it that way. States require a sales tax to be paid on a leased vehicleSome states charge the tax on the amount of the down payment while others base the tax on the total of the monthly lease payments.

Do you have to pay taxes on leased car. This is different from most other states in which no such tax is charged to the lessor or the tax is administered in a different way. When you lease a car in most states you do not pay sales tax on the price or value of the car.

Jan 13 2013. However if you rent out the leased equipment without operating it yourself a sales and use tax applies. The standard tax rate is 625 percent.

In other states such as Illinois and Texas see Texas Auto Leasing you actually pay sales tax on the full value of the leased car not just the leased value just as if you were buying it. Since leased vehicles produce income for the leasing company and are taxable to the leasing company. Instead sales tax will be added to each monthly lease payment.

In Texas all property is taxable unless exempt by state or federal law. Only the service is charged tax. That being said if you trade the car in now versus just selling it outright to Carmax or whoever you will pay less taxes on the new vehicle purchase.

The standard tax rate is 625 percent.

What S The Car Sales Tax In Each State Find The Best Car Price

Printable House Rent Receipt How To Create A House Rent Receipt Download This Printable House Rent R Receipt Template Invoice Template Invoice Template Word

Texas Car Sales Tax Everything You Need To Know

Which U S States Charge Property Taxes For Cars Mansion Global

Are There Tax Advantages To Leasing A Car Under Your Business

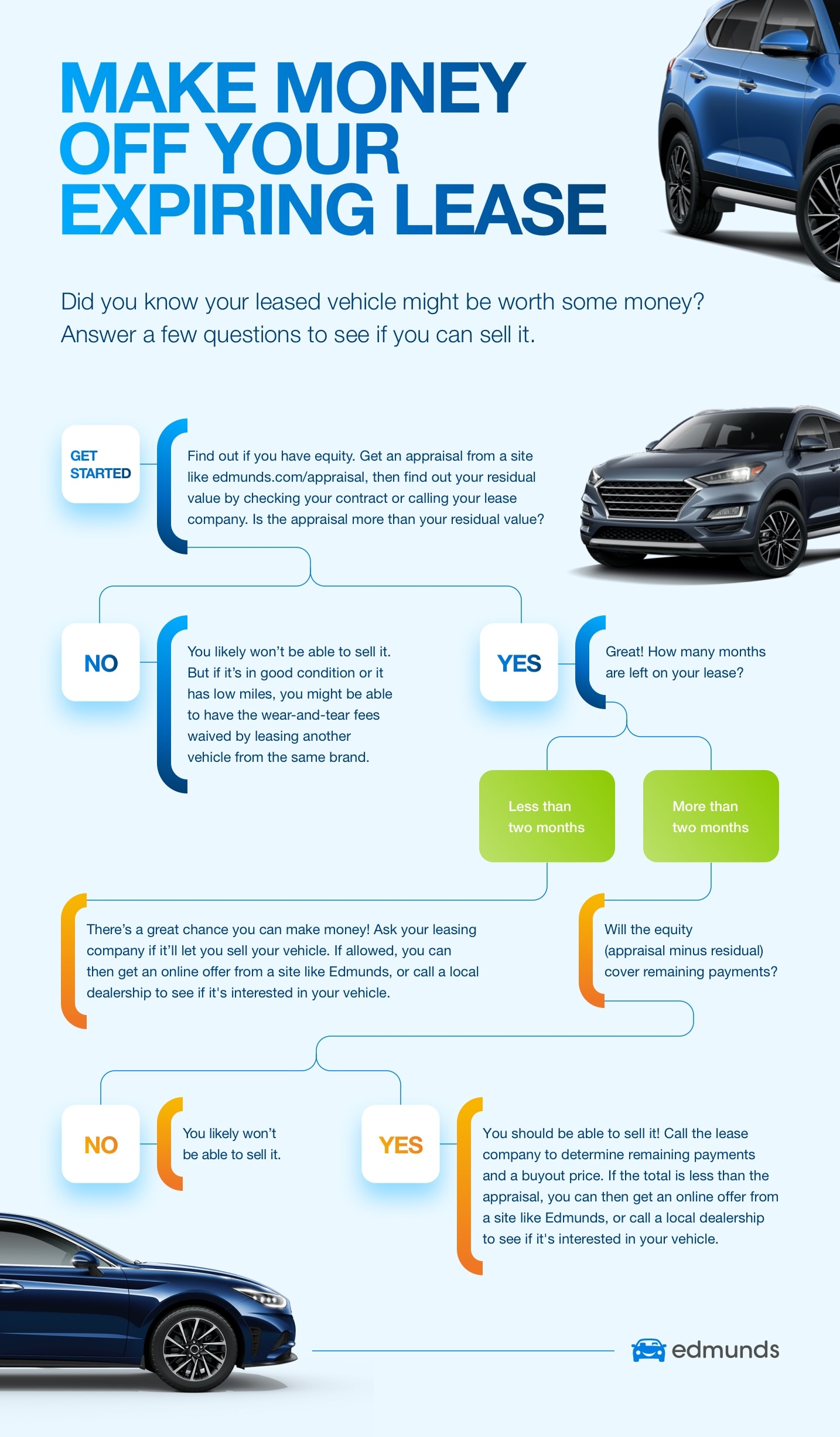

Consider Selling Your Car Before Your Lease Ends Edmunds

Must See Exclusive And Limited New Construction By J Lambert Custom Homes New Construction Custom Homes Fort Worth

Leasing Vs Buying A Car Which Offers More Tax Savings Turo Tax Tips